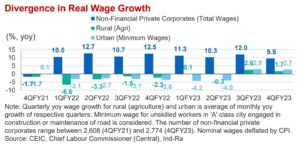

India Ratings & Research has revised its GDP growth projection for India in 2023-24, increasing it by 30 basis points to 6.2%. However, the agency has issued a warning about the sustainability of current domestic consumption levels. Principal Economist Sunil Sinha emphasized that while real wage growth for those in the upper-income bracket has been strong, those in the lower 50 percent of income earners have recently experienced negative real wage growth.

This discrepancy is reflected in consumption patterns, where demand for higher-priced items like cars above Rs 10 lakh has risen, while demand for motorcycles has not seen the same level of growth. Similar trends are observed in areas like air travel versus rail passenger traffic and luxury versus affordable housing.

Sinha expressed concern that while aggregate consumption demand may appear stable, there is a disconnect at the disaggregated level. He stressed that such consumption patterns may not be sustainable unless the lower-income bracket also experiences increased consumption demand, particularly for mass consumption items.

The comments from India Ratings & Research come shortly after India’s GDP growth surged to 7.8% in April-June, driven by a 6.0% year-on-year growth in private consumption. Sinha highlighted the importance of addressing this consumption pattern for the long-term health of the economy.

With real income growth insufficient to support consumption, households have turned to borrowing, as indicated by data from the Reserve Bank of India (RBI). Household liabilities in 2022-23 were 76% higher than the previous year, with borrowing from commercial banks rising by 54%. This trend has led to a decrease in net financial savings, which could have broader implications for the economy, as households are a significant source of investment.

Sinha pointed out that reducing inflation to the 4% target and promoting economic growth can indirectly help raise real wage growth and alleviate consumption concerns. According to Devendra Pant, chief economist at India Ratings, a 1% increase in real wage rates could boost GDP growth by 64 basis points. Achieving this increase in real wage rates is possible with a 1% reduction in inflation.

India Ratings & Research predicts that headline retail inflation may average 5.5% in 2023-24, potentially allowing the RBI to maintain a repo rate of 6.5% and adopt a “long pause” approach to interest rate policy.

The concern over consumption patterns underscores the need for balanced economic growth that benefits all income brackets for sustained economic stability in India.