Bajaj Finserv: Triangle Breakout Sparks Bullish Momentum

Ascending Triangle Fuels Upward Surge

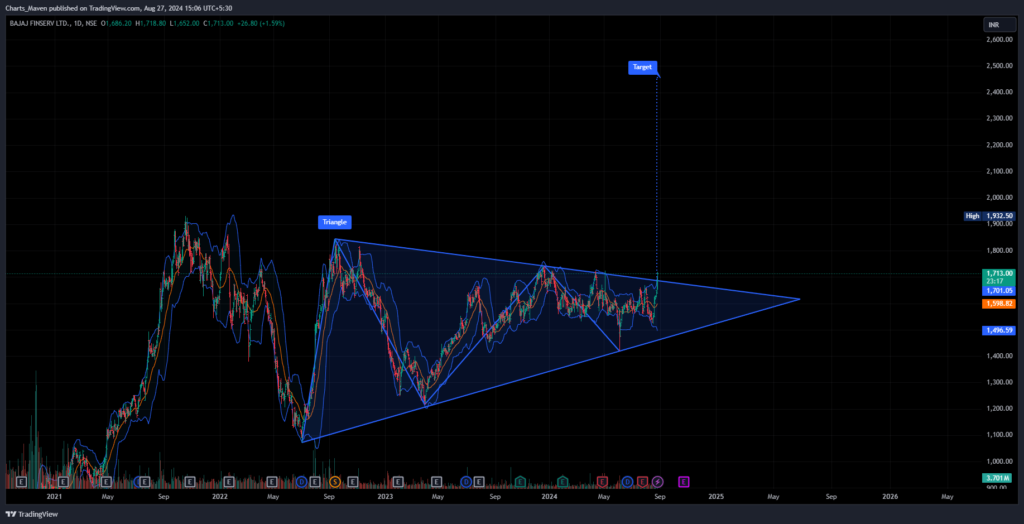

Bajaj Finserv’s stock is currently demonstrating a classic technical breakout, having surged past the upper trendline of an ascending triangle pattern. This bullish signal, coupled with the stock’s robust fundamentals, strongly suggests a potential continuation of its upward trajectory.

Chart Analysis: Unveiling the Price Action

The ascending triangle formation, characterized by a flat upper trendline and a rising lower trendline, typically indicates buying pressure accumulating as the price consolidates. The recent breakout at approximately ₹1,930 confirms this bullish bias.

Upside Potential: Targeting Higher Price Levels

Furthermore, the measured move target for an ascending triangle breakout projects a potential price objective around ₹2,200. This target is derived by adding the height of the triangle’s base (approximately ₹270) to the breakout level. While this target serves as a technical guide, it’s important to remember that actual price action may exceed or fall short of this estimate.

Fundamental Strength Reinforces Technical Outlook

In addition to the positive technical picture, Bajaj Finserv’s solid financial performance and growth prospects further underpin the bullish outlook. The company’s diversified business model, strategic initiatives in health insurance and fintech partnerships, coupled with the favorable macroeconomic environment in India, create a compelling narrative for sustained growth.

Investor Takeaway: Navigating the Bullish Tide

For investors, this breakout presents a potential opportunity to participate in the upward momentum. Consequently, closely monitoring price action and trading volume will be crucial in the coming days to gauge the strength of the trend.

Risk Management Remains Essential

While the outlook appears positive, prudent risk management is always crucial in any investment. Therefore, utilizing stop-loss orders or other risk mitigation strategies can help protect against potential market reversals.

Disclaimer: This blog post offers insights, not financial advice. Investing carries inherent risks. Conduct thorough research and consider your financial situation before making investment decisions.

Key Improvements: