Vodafone Idea: Breaking Out, Aiming High, But Tread with Caution

Vodafone Idea: Breaking Out, Aiming High, But Tread with Caution

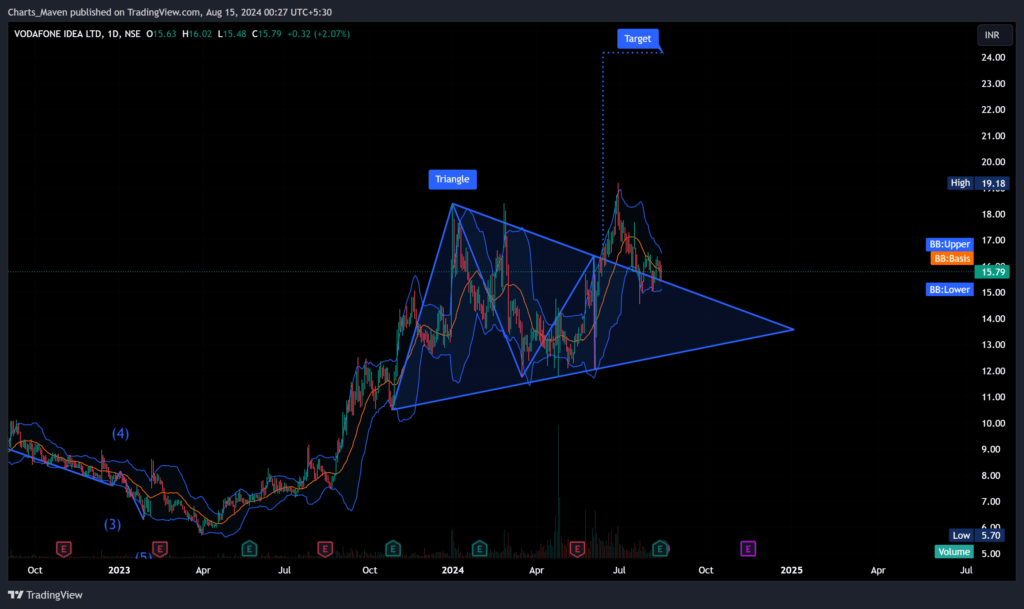

The Vodafone Idea (NSE: IDEA) chart is painting an intriguing picture, hinting at potential upside while also underscoring the inherent risks in this volatile stock. Let’s delve into the technical and fundamental aspects to understand the current scenario and future possibilities.

Technical Analysis

- Triangle Breakout: The stock has decisively broken out of a symmetrical triangle pattern, a bullish signal suggesting a continuation of the prior uptrend.

- Upside Targets: The chart indicates a potential target of INR 24.00. However, a crucial hurdle lies at INR 19.18 (prior high). A convincing close above this level would significantly strengthen the bullish case.

- Invalidation Level: A breakdown below INR 14.55 would likely invalidate the bullish setup, potentially leading to further downside.

Fundamental Analysis

While the technical picture looks promising, the fundamental situation remains challenging for Vodafone Idea. The company is grappling with intense competition, a heavy debt burden, and regulatory hurdles. However, recent developments, such as tariff hikes and potential government support, have offered a glimmer of hope.

My Views

- Cautious Optimism: The technical breakout is encouraging, suggesting potential for further upside. However, the fundamental challenges cannot be ignored.

- Key Levels to Watch: The INR 19.18 level will be crucial to watch. A successful breakout above this could pave the way for the ambitious target of INR 24.00. On the downside, a breach of INR 14.55 would necessitate a reassessment of the bullish outlook.

- Risk Management is Key: Given the inherent volatility and fundamental uncertainties, risk management is paramount. Investors should consider using appropriate stop-losses and position sizing to protect their capital.

Conclusion

Vodafone Idea presents a high-risk, high-reward scenario. The technical setup hints at potential gains, but the fundamental picture remains a concern. Investors with a high-risk appetite might consider taking a position, but only with strict risk management in place.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money. Always do your research and consult a financial advisor before making any investment decisions.

Remember: The stock market is dynamic and subject to change. Stay updated on news and developments related to Vodafone Idea and the broader telecom sector.