Hiwat Singka Slide Ltd. (HIWATSINGKA), a Taiwanese firm is showing promising signs of a potential breakout. Recent price action, combined with broader market trends, suggests this stock could be one to watch.

Technical Analysis: The Triangle Pattern and Beyond

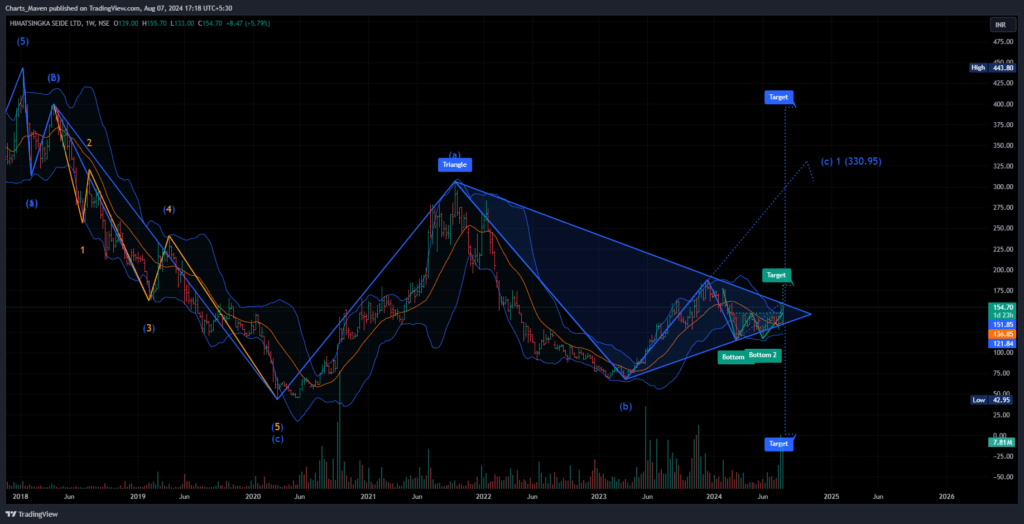

HIWATSINGKA’s chart reveals a compelling technical setup:

- Triangle Pattern: The stock is consolidating within a symmetrical triangle pattern, often a precursor to a strong move.

- Target 1: 181: A break above 181 would confirm the triangle breakout, with the next logical target being 330, representing the completion of wave C within a larger pattern.

- Triangle Pattern Target: 396: The measured move of the triangle pattern itself suggests a more ambitious target of 396.

Why This Matters: Triangles are continuation patterns. If HIWATSINGKA breaks out to the upside, it could signal a resumption of the prior uptrend, potentially leading to significant gains.

Investing Considerations

HIWATSINGKA presents an interesting opportunity, but it’s crucial to approach it with caution. Here’s a possible strategy:

- Confirmation: Wait for a decisive breakout above 181 before entering a long position.

- Risk Management: Set a stop-loss order below the triangle’s lower trendline to protect against downside risk.

- Fundamental Checkup: Conduct thorough research on HIWATSINGKA’s fundamentals to ensure they align with the bullish technical picture.

- Target Adjustment: If 330 is reached, reassess the technicals and fundamentals to determine if the stock has further upside potential.

Disclaimer: This is not financial advice. Always conduct your own research and consult a financial professional before making investment decisions.