TATA Motors Ltd. : Riding High on Wave 3

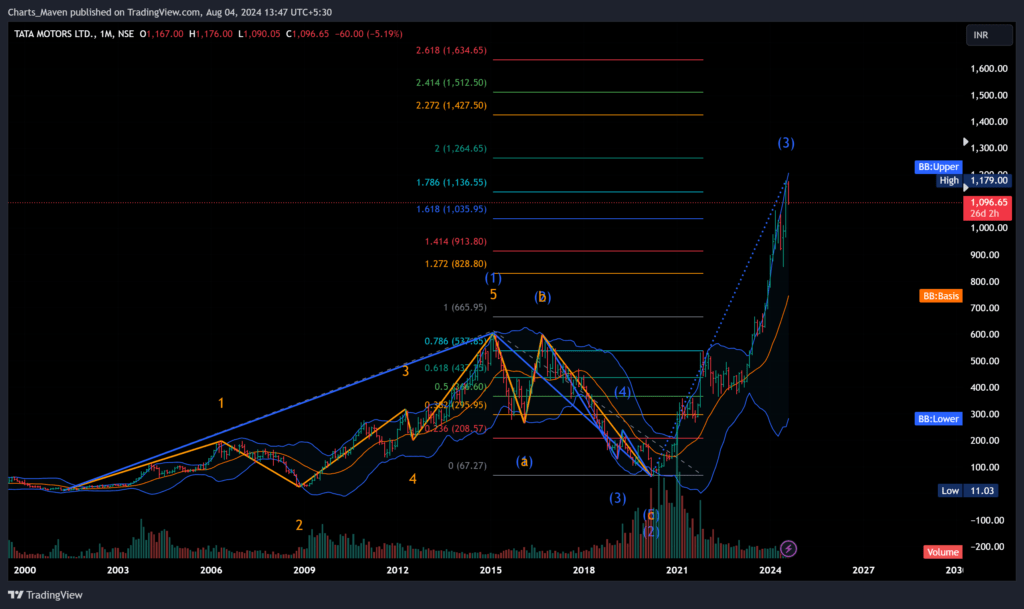

The stock price of TATA Motors Ltd. (NSE: TATAMOTORS) is on a remarkable upward trajectory, currently trading near its all-time high. Through the lens of Elliott Wave analysis, we find that this impressive rally aligns with the characteristics of Wave 3.

Elliott Wave Theory: A Powerful Tool for Technical Analysis

Elliott Wave Theory posits that market prices move in predictable patterns, consisting of five waves in the direction of the main trend (waves 1, 2, 3, 4, and 5), followed by three corrective waves (waves A, B, and C). Wave 3 is typically the most powerful and longest wave in the sequence, often extending 1.618 times the length of Wave 1.

TATA Motors in Wave 3: Potential for Explosive Growth

Our technical analysis suggests that TATA Motors is currently in the midst of Wave 3, as indicated by the strong momentum and extended price movement. This presents a significant opportunity for substantial gains. Based on Elliott Wave projections, the stock has the potential to reach 1634 from its current price of 1096.65. This would represent a gain of over 50%.

Fundamental Factors Supporting the Bullish Outlook

The promising technical outlook is reinforced by robust fundamental factors. TATA Motors is experiencing strong demand for its vehicles in India and other emerging markets. The company’s strategic focus on electric vehicles (EVs) aligns well with global trends and government initiatives. Furthermore, the Indian government’s supportive policies for the auto industry are creating a favorable environment for growth.

Technical Analysis: Confirming the Upward Momentum

Technical indicators also support the bullish thesis. The stock is trading above its key moving averages, and the relative strength index (RSI) is in overbought territory, indicating strong momentum. However, it’s important to be mindful of potential pullbacks, especially as the stock approaches overbought levels.

Risk Management: The Potential Downside

While the outlook is optimistic, prudent risk management is crucial. The chart suggests a potential downside of 1035, representing a loss of over 5% from the current price. Factors such as a slowdown in the Indian economy, rising interest rates, or increased competition could trigger such a correction.

Conclusion

TATA Motors Ltd. presents an attractive investment opportunity, fueled by its current position in Wave 3 of the Elliott Wave cycle and strong fundamental factors. The potential for substantial gains is significant, but investors should be mindful of the inherent risks and consider appropriate risk management strategies.

Disclaimer: This analysis is based on Elliott Wave Theory and fundamental/technical analysis. It is not financial advice. Please conduct thorough research and consult with a financial advisor before making any investment decisions.