Introduction

Berger Paints is a leading Indian paint company with a strong presence in the decorative and industrial paints segments. The company’s stock has been on a tear in recent months, and it is currently trading near its 52-week high. In this blog post, we will take a look at the technical analysis of Berger Paints and discuss the potential for further upside.

Technical Analysis

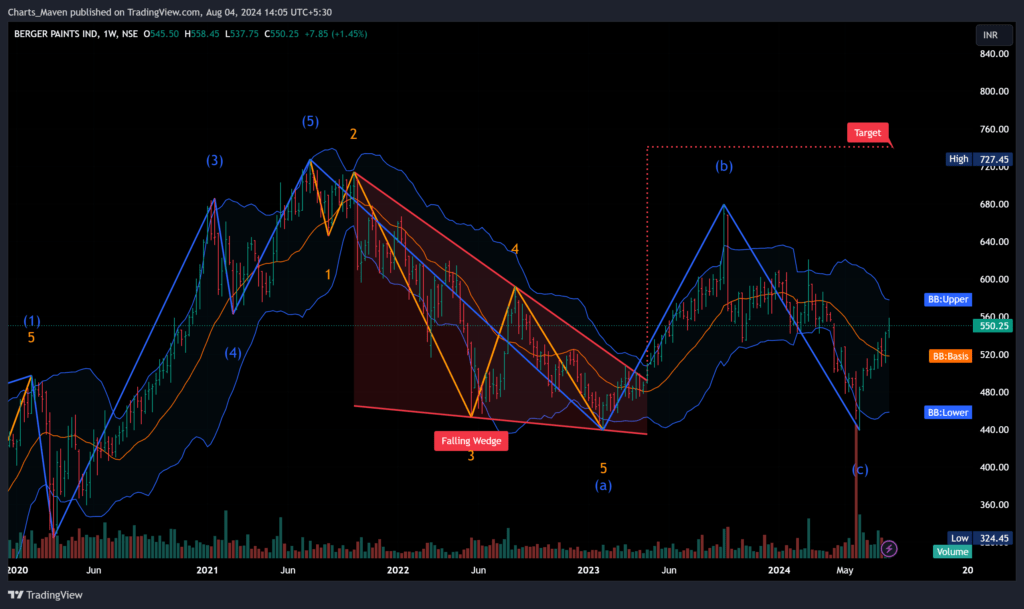

The technical analysis of Berger Paints suggests that the stock is in a strong uptrend. The stock has recently broken out of a falling wedge pattern, which is a bullish reversal pattern. Additionally, the stock is trading above its 50-day and 200-day moving averages, which is also a bullish sign.

The Elliott Wave Theory is a technical analysis tool that can be used to identify potential turning points in the market. The Elliott Wave Theory suggests that the stock is currently in wave 3 of a five-wave uptrend. Wave 3 is typically the longest and strongest wave in an uptrend.

Fundamental Analysis

The fundamental analysis of Berger Paints is also positive. The company is expected to benefit from the growth of the Indian economy and the rising demand for paints in India. Additionally, the company has a strong track record of profitability and growth.

Conclusion

The technical and fundamental analysis of Berger Paints suggests that the stock has the potential to continue its upward trend. The stock is currently trading near its 52-week high, but it could still have room to run. Investors should keep a close eye on the stock and be prepared to buy if it breaks out to new highs.

Disclaimer

I am not a financial advisor and this is not financial advice. Please do your own research before making any investment decisions.

- The Elliott Wave Theory is a complex technical analysis tool. It is important to do your own research before using this tool.

- The fundamental analysis of a company is important, but it is not the only factor that should be considered when making investment decisions.

- It is important to diversify your portfolio and not invest all of your money in one stock.

Additional Resources

- Berger Paints website: https://www.bergerpaints.com/

- Elliott Wave International: https://www.elliottwave.com/